Table of Content

Union bank lays great emphasis on the credit score and it acts as the benchmark for application of rate of interest as well as the quantum of loan eligibility. In such an eco-system the importance of a high-net-worth individual cannot be discounted. On the flipside, there is no definite measure to define who a high-net-worth individual is. In layman’s terms the individual can be classified as such if he has abundant liquid assets as compared to meager liabilities. But then, this is bound in geographical countries based on economy.

It is critical that during your home search you consider properties which are free of encumbrances of any sort. A similar process can be followed to get the home loan certificate from other banks as well. The maximum repayment period will be Five years subject to the condition that repayment should be co-terminus with retirement. Union Bank will never send you e-mails asking for confidential details of your account/ PIN/ Password or personal details. The Union Paradise Home Loan is ideally suited for NRI borrowers for the wide coverage of needs that it offers.

Union Bank of India Home Loan Interest Rates

Evaluation and sanction of the loan based on the submitted documents. Submission of a fully complete form along with the requisite documents. Can I apply for Union Bank of India Home Loan online? Yes, you can apply online through the Union Bank of India website.

BankBazaar Union Bank of India Home Loan EMI Calculator is one such online tool that will help you get an idea of the EMIs you need to pay to the bank during the tenure. The repayment shall commence from succeeding month of first disbursement of loan. The applicant should be customer of the bank for at least 6 months prior to applying for loan. Answer- We will determine Home Loan Eligibility largely by your income and repayment capacity.

Bankbazaar

Just log on to Personal Banking section of the Internet Banking site with your credentials and select the "Home Loan Int.Cert " link under "Enquiries" tab. Then select the account for which you require a Home Loan Interest Certificate. The certificate can be viewed online, printed or downloaded in pdf.

As we know, the principal and EMI component of a home loan are subject to respective tax deductions. Apart from this, stamp duty charges and registration fees can also be considered as deductions. One/two guarantors of Indian Residents , having means equivalent to that of the loan amount, is to be provided by the NRI applicant. However, interim security is not required if tie-up with the builder for the particular housing project exists. There is no prepayment penalty / take-over penalty if loan is taken over by other banks/FIs. Purchase of solar power panel along with purchase / construction of house.

Corporate Loans

Among these, the Union Paradise Home Loan specially designed for the NRIs are in high demand. As far as the scheme goes, it is very much like the Union Home Loan Scheme in its features and facilities. However, being a NRI, you will have to comply with additional documentation typically relevant in your case. Additionally, you will need to assign a close blood relative co-applicant and a suitable Power of Attorney in his /her favor.

Operating out of their headquarters in Mumbai, the commercial capital of India, the bank boasts of a robust Retail Banking business aimed at fulfilling the dreams of their customers. In keeping with their focus, UBI offers a vast array of home loan solutions to their clientele of all hues in an endeavor to bridge the funding gap in home ownership. Union bank is one of the leading public sector banks with a legacy of almost hundred years since its establishment in 1919. UBI plays an important role in the housing sector in the country where the scope to fund construction or purchase of a house or flat is enormous. Can be availed for purchase/construction of a house, repairs/improvements/extension of an existing property. Knowing the Equated Monthly Instalments payable on your loan is of utmost importance when it comes to getting a housing loan.

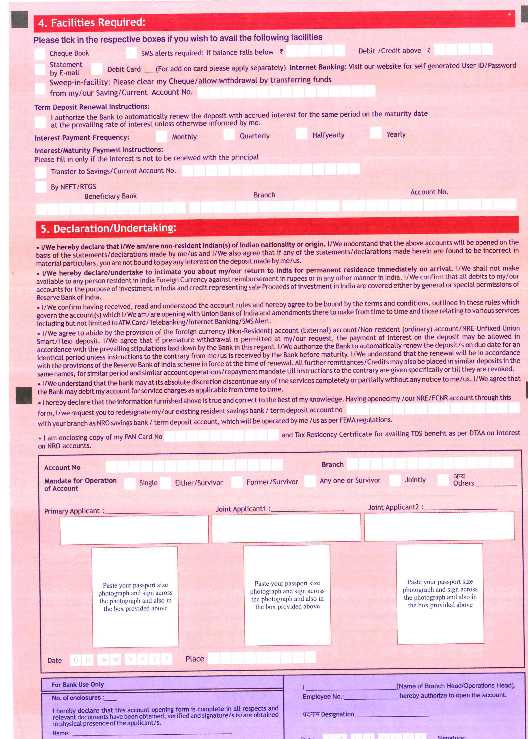

Deposit will be auto renewed for the same period at the applicable rate of interest on maturity in the absence of specific instruction. Any Resident Individual - Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Blind persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc. Trusts, Institutions/Agencies specifically permitted by the RBI eligible to open a "Deposit Reinvestment Certificate" Account" in single/joint names.

Any immediate family member – your parents, spouse, earning children, or siblings – is permitted to be a co-applicant for a loan. Adding a co-applicant will increase your loan eligibility as the income of the co-applicants will also be considered while determining the eligible loan amount. The process to obtain the home loan interest certificate from your bank is fairly simple and can be done right from the comfort of your home. A majority of lenders these days have made it possible for their customers to access the interest certificate online. Home loan borrowers can now view / download Interest Certificate of their home loan account using /personal.

It is time to have a glimpse at the different rates of interest applied to them. The marginal costs of funds-based lending rates at Union Bank of India have increased by 5 basis points for all tenures. The updated interest rates will be in effect from 11 December 2022 to 10 January 2023 based on the information uploaded on the bank's website. Yes, you can choose to prepay your loan. The bank offers a full waiver of prepayment charges if the loan is being prepaid through personal sources or through balance transfer to another bank.

However, the moratorium period is not applicable to loans availed for the purchase of a completed house/flat. Union Bank offers home loans at competitive rates starting from 8.25% p.a. The good part is you don’t have to pay any prepayment penalty fee if you decide to foreclosure the loan . The applicable processing fee is 0.5% of the sanctioned amount plus GST.

There are different ways to get home loan certificate from Axis Bank. A similar process can be followed to get the interest certificate from HDFC Bank as well. One of the most important uses of a home loan certificate is to claim tax deductions.

This is an ideal scheme for investing a lump sum amount where interest is compounded quarterly and paid along with the principal amount invested. Please report immediately on phishingunionbankofindiacom if you receive any such email/SMS or Phone call. There is no prepayment penalty if loan is prepaid from own verifiable sources. Moratorium period of to 12 months in case of repair & renovation. Minimum entry age is 18 years and maximum exit age up to 75 years.

No comments:

Post a Comment